In the world of tax preparation, understanding the intricacies of the Handr Block schedule can be a game-changer. As tax season approaches, individuals and businesses alike scramble to ensure their financial records are in order. The Handr Block schedule serves as a crucial tool for organizing and managing tax information effectively. By familiarizing yourself with how this schedule works, you can not only streamline your tax preparation but also potentially maximize your refunds and minimize your liabilities.

For many, taxes can feel overwhelming and confusing, but with the right guidance and a clear understanding of the Handr Block schedule, you can navigate the complexities with ease. This article aims to demystify the Handr Block schedule, providing insights into its structure, purpose, and practical applications. Whether you are a first-time filer or a seasoned taxpayer, knowing how to utilize this schedule can enhance your overall experience during tax season.

Additionally, you will learn about the various components of the Handr Block schedule and how they relate to your financial situation. From deductions to credits, this guide will equip you with the knowledge necessary to make informed decisions regarding your taxes and ultimately help you achieve financial wellness.

What is the Handr Block Schedule?

The Handr Block schedule is a detailed outline provided by the tax preparation company H&R Block, which assists taxpayers in organizing their financial information. It is designed to ensure that all relevant data is captured, making the tax filing process smoother and more efficient. This schedule typically includes sections for income, deductions, credits, and other essential tax-related information.

How Does the Handr Block Schedule Work?

Understanding how the Handr Block schedule functions is critical for effective tax preparation. The schedule is structured to guide taxpayers through various sections that need to be filled out. Here’s a breakdown of how it works:

- Income Section: This part captures all sources of income, including wages, business income, and investment earnings.

- Deductions: Taxpayers can list all eligible deductions, which reduce their taxable income.

- Tax Credits: This section allows for the inclusion of credits that can directly reduce the tax owed.

- Final Review: Once completed, the schedule should be reviewed to ensure accuracy before submission.

Why is the Handr Block Schedule Important?

The importance of the Handr Block schedule cannot be overstated. It not only simplifies the tax filing process but also helps taxpayers optimize their tax returns. By keeping track of income and deductions, individuals can identify potential areas for savings. Moreover, a well-organized schedule can prevent errors that may lead to audits or penalties.

Who Should Use the Handr Block Schedule?

While anyone can benefit from using the Handr Block schedule, it is particularly advantageous for:

- Individuals with multiple sources of income.

- Freelancers or self-employed individuals.

- Taxpayers claiming various deductions and credits.

- Anyone looking to ensure accuracy in their tax filings.

What Are the Benefits of Using the Handr Block Schedule?

Using the Handr Block schedule offers numerous benefits, including:

- Enhanced Organization: The schedule helps keep all tax-related information in one place.

- Time Savings: By organizing data beforehand, the actual filing process becomes quicker.

- Better Financial Awareness: Taxpayers gain insights into their financial situation by reviewing their income and expenses.

- Reduced Stress: Knowing that all information is accurately captured alleviates the anxiety associated with tax season.

How Can You Access the Handr Block Schedule?

Accessing the Handr Block schedule is relatively simple. Taxpayers can obtain it through various channels:

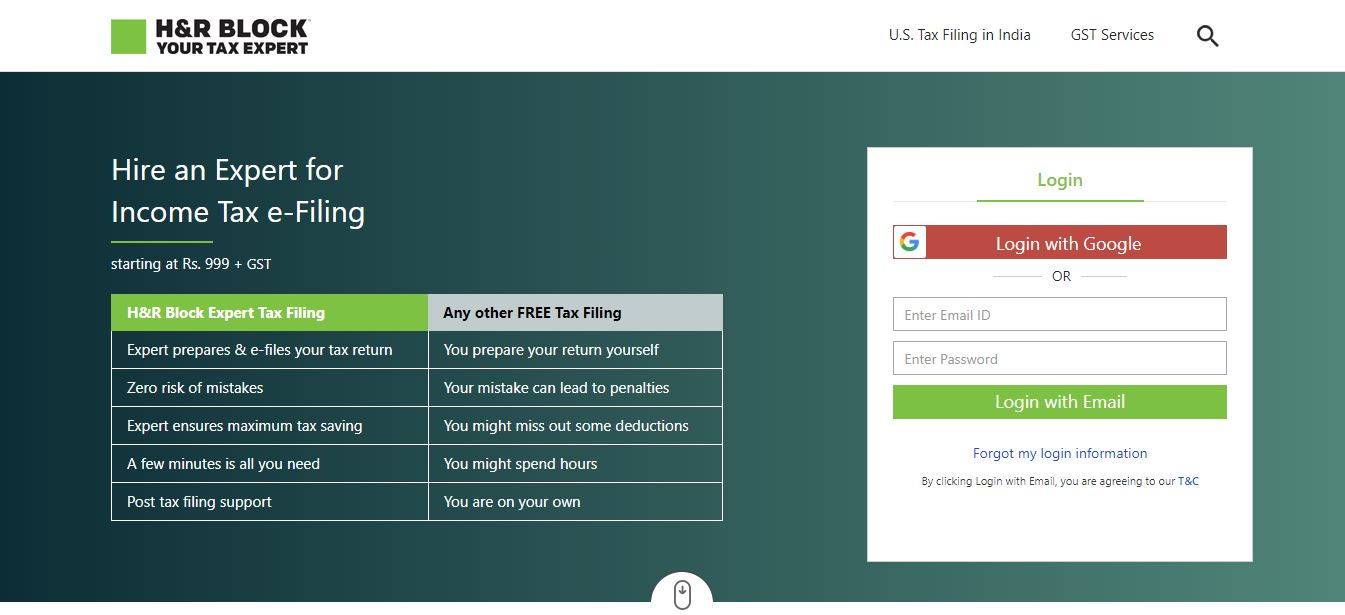

- Online: H&R Block’s official website provides access to the schedule and other tax preparation resources.

- In-Store: Those who prefer face-to-face assistance can visit any H&R Block office to request the schedule.

- Mobile App: H&R Block also offers a mobile app that includes the schedule and additional features for tax preparation.

What Should You Keep in Mind When Using the Handr Block Schedule?

When utilizing the Handr Block schedule, it’s essential to keep a few things in mind:

- Accuracy is Key: Ensure that all information entered is accurate to avoid issues with the IRS.

- Stay Updated: Tax laws can change, so it’s important to stay informed about any updates that may affect your filing.

- Consult a Professional: If you have complex financial situations, consider consulting with a tax professional for guidance.

Can the Handr Block Schedule Help Maximize Your Refund?

Yes, utilizing the Handr Block schedule can potentially maximize your refund. By ensuring that all income is reported and all eligible deductions and credits are claimed, taxpayers can optimize their return. Additionally, the schedule encourages thoroughness, which helps identify any overlooked opportunities for savings.

Conclusion: Embrace the Handr Block Schedule for Financial Clarity

In conclusion, the Handr Block schedule is a vital resource for anyone looking to navigate the complexities of tax preparation. By understanding its structure and effectively utilizing its components, taxpayers can enhance their filing experience and achieve better financial outcomes. Whether you are a novice or a seasoned taxpayer, the Handr Block schedule is undoubtedly a tool worth embracing.